Car sales: six charts that tell a story

BBC

BBCSix months ago Britain's car-buying boom seemed unstoppable.

But now, for the first time in six years, sales in the all-important month of September have fallen sharply.

September is traditionally a bumper month, as the new "67" plate would have encouraged people to buy.

The Society of Motor Manufacturers and Traders (SMMT) has blamed economic uncertainty and a lack of consumer confidence.

Worries about diesel engines have contributed to a collapse in sales. But why else might the boom be over?

Ditching Diesel

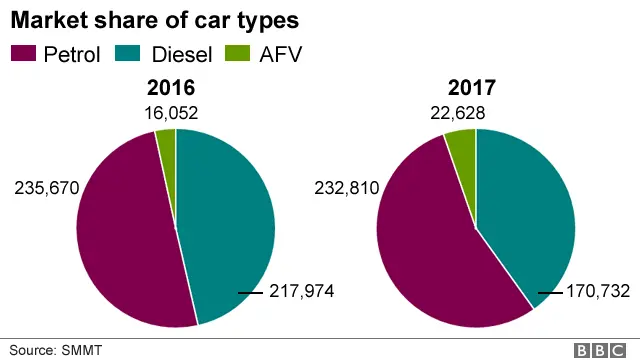

Sales of diesel cars fell by 21.7% in September 2017, compared to the same month last year.

That amounts to 170,000 diesel sales last month, compared with 217,000 in September last year.

Worries about increasing taxes on heavily-polluting cars are likely to be behind that, or concern for the environment.

Meanwhile, sales of alternatively-fuelled vehicles (AFVs) - including electric cars - rose by 41%, up from 16,000 vehicles to over 22,000. Sales of new cars with petrol and diesel engines are due to be banned in the UK from 2040.

Cutting back on credit?

Most people buy cars on credit. Figures from the Bank of England show that even though the total amount of outstanding consumer credit is growing - partly because of inflation - the growth rate is falling.

In other words, consumers may be worried about falling real incomes. So they are less likely to want to increase their monthly outgoings by buying a new car.

The peak growth rate of consumer credit was in November last year. Since then the rate has been falling.

Fewer PPI windfalls

According to the Financial Conduct Authority the average pay-out for the mis-selling of Payment Protection Insurance (PPI) is between £2,000 and £3,000. It is thought that many of the 13 million people who have received such sums may have spent them on buying a new car.

But as the chart below shows, the number of PPI complaints being filed is falling. So fewer people may be getting that windfall cash.