Somalia's 'touch and feel' e-commerce hit

Innovate Ventures

Innovate VenturesWhen Saed Mohamed, a young entrepreneur from Somalia, pitched his online shopping business Muraadso as part of an East African start-up competition in 2015, he was prepared for rejection.

And rejection is what he got.

Abdigani Diriye, co-founder of the Somalia-based accelerator, Innovate Ventures, which oversaw the competition, was not impressed.

"We had a few applications from e-commerce start-ups and they just weren't really doing it for me," he told the BBC.

But Mr Mohamed and his team were not about to give up.

"We have had a lot of rejections and we have learned to be persistent. We wouldn't take no for an answer," he says.

They did eventually get on the programme and ended up winning it.

"The irony is they went on to become the most successful start-up we took on," joked Dr Diriye.

But the business they were pitching - a online store selling mainly electronics - "failed miserably" at first, admits Mr Mohamed.

Muraadso

MuraadsoIt seemed Somalia wasn't ready yet for online only. Perhaps this isn't surprising given that less than a third of its 14 million people are able to access the internet and few have bank accounts. It's an uphill struggle to get any online business off the ground.

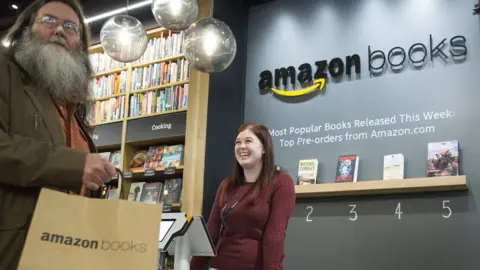

So he looked to how Western retailers were combining offline and online sales to revive the flagging brand.

"The hybrid model is the thing right now. Amazon has opened a physical store and Walmart and other traditional retailers are acquiring e-commerce sites," he told the BBC.

Muraadso did the same and "sales sky-rocketed," he said.

Opening bricks and mortar stores in three different cities meant that potential buyers could go and touch the goods first before committing to buying them.

The site offers traditional home deliveries and flexible ways to pay, including cash on delivery.

Getty Images

Getty ImagesMany purchase are made via mobile money transfer service, Zaad, which operates in a similar way to Kenya's famous M-Pesa platform.

Zaad has an 80% market share in Somalia, charging no fees to send or withdraw money, but making its money instead from offering extra services and mobile airtime.

"The hybrid model wasn't a concept that I was familiar with, but Muraadso started implementing it late last year and they have been growing ever since, going from a three-man team to employing dozens and looking to raise another round of funding," says Dr Diriye.

E-commerce in Somalia is nascent, and across Africa generally, online shopping remains niche, says Matthew Reed, a consultant at research firm Ovum.

"Many people are still living on desperately low incomes, so e-commerce is really just for the middle classes. And there are other big challenges for e-commerce firms, not just in Somalia," he says.

AFP/Getty Images

AFP/Getty ImagesChief among them is lack of infrastructure - both decent roads that enable quick and efficient deliveries, and the telecoms infrastructure that allows people to access the platforms in the first place.

But things are changing.

Millions in Africa have bypassed traditional telephone landlines and leapt straight to mobile - the oft-quoted "leapfrog" effect. According to mobile body the GSMA, there will be 725 million unique mobile subscribers on the continent by 2020.

And Somalia is benefiting from this improved connectivity.

In 2013, fibre optic firm Liquid Telecom connected the East African country to its network of cables, which now spreads 50,000km (31,000 miles) across 11 other African countries.

"There is increasing connectivity, mobile is increasingly widely available, and more of that is data-enabled with the increase of 3G and 4G networks," says Mr Reed.

More Technology of Business

Getty Images

Getty Images

"Devices are also becoming more affordable."

Changing social and cultural patterns of behaviour, an increasingly youthful population, and urbanisation, mean the stage is set for e-commerce to thrive, he believes.

According to Mr Mohamed, Facebook is "huge" in Somalia among younger people, so Muraadso is aggressively exploiting the platform to market its products, gaining 25,000 likes along the way. It aims to have 100,000 by the end of the year.

Perhaps unsurprisingly, South Africa has the most mature e-commerce market in Africa, with others such as Kenya and Nigeria gaining user quickly.

Getty Images

Getty ImagesOnline retailer Jumia is in all three countries and, while it offers a very similar set of services to global market leader Amazon, there is one crucial difference.

"They realised that they couldn't just copy-and-paste the approach and methodology of Amazon because of factors such as infrastructure, access to couriers and cultural preferences," explains Dr Diriye.

So Jumia pioneered the idea of letting customers see the goods before they paid for them.

Safaricom, Kenya's leading communications firm, recently announced that it would be launching its own online shopping offering by the end of the year and it plans to expand that service beyond Kenya.

Muraadso is still small - its turnover is at around $40,000 (£30,000) a month - but already it has a rival - Samionline - and Dr Diriye predicts more will follow.

"Every day another one pops up in Somalia as the digital wave starts to flow," he says.

"People are getting online, becoming more tech-savvy and the cost of owning a smartphone is falling."

The benefits to the people of Somalia go beyond access to better quality goods and more choice, he adds.

"It also saves them time as they don't have to travel to town, and it saves them money because they don't have to pay for a bus.

"People are more productive with their time, and when you multiply that to a whole city or country, the impact can be very significant."