Highest rate taxpayers at record level

PA

PAA record number of people are paying the highest rate of income tax, but remain a fraction of total taxpayer numbers.

An estimated 364,000 people are paying the 45p rate of tax on income over £150,000, up from 311,000 in 2013-14.

They represent 1.2% of income tax payers in the UK, figures from HM Revenue and Customs (HMRC) show.

The number of people paying at the basic (20%) and higher (40%) rates of tax has fallen slightly.

Pension changes

The latest estimates show that 25.1 million (81.8% of taxpayers) were paying tax at the basic rate.

A further 4.2 million individuals (13.7% of taxpayers) pay tax at the higher 40% rate.

These numbers are likely to have been relatively static, owing in part to the increase in the threshold at which these rates of income tax are paid.

In 2010, the income tax personal allowance - the amount you are allowed to earn before paying any income tax - was £6,475. This year it is £11,500, having risen considerably faster than inflation.

In contrast, the threshold of £150,000 has been frozen, meaning the numbers paying the highest rate of tax may increase even if pay rises at this top end rise no faster than the cost of living. There have also been changes to pension rules for the most well-off.

Tom McPhail, head of policy at Hargreaves Lansdown, said: "More and more low earners are being taken out of the tax system altogether, basic-rate taxpayers are paying a lower overall average rate of tax and whilst top earners' share of income is declining, their contribution to the income tax system is increasing.

"A significant contributory factor are the cuts to the reliefs and allowances on pensions."

Million incomes

The figures also show that the top 1% of taxpayers had a 12% share of total income, and were liable for 27.7% of all income tax.

It is estimated that 15,000 UK taxpayers have incomes above £1m, of which 4,000 have incomes above £2m, the figures show.

In total, there are now an estimated 30.3 million taxpayers in the UK.

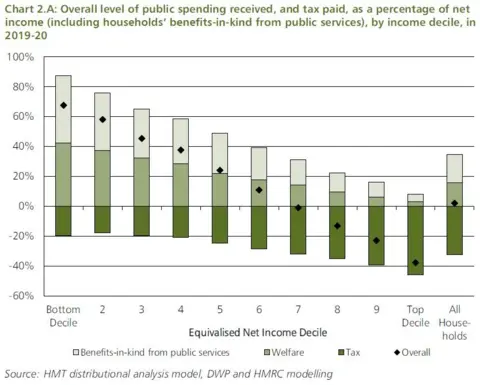

The Treasury published analysis at the time of the Budget predicting what proportion of incomes people would be spending on all taxes by 2019-20.

HM Treasury

HM Treasury