'It's going to get worse': US car buyers brace for sweeping auto tariffs

For two years, Jeannie Dillard has saved what she can on her fixed income to replace the vehicle that was stolen from her home and found totalled a few miles away.

She looked around a used car dealership in Virginia on Thursday, peering at sticker prices with a newfound worry: blanket tariffs on foreign cars and car parts that experts warn could drive up prices in the US, which kick in next week.

She'd like to buy a car now, she said, but "I have to wait until my finances improve".

Ms Dillard is among the plethora of Americans bracing for expected economic turbulence under President Donald Trump's sweeping auto tariffs - an unprecedented US trade policy manoeuvre.

"It took me a long time to save up for the last car," she said. "If prices get too high, I'm obviously not going to buy something that I can't afford."

She added: "We'll just have to wait and see."

On Wednesday, Trump announced new import taxes of 25% on cars and car parts entering the US from overseas, which go into effect on 2 April.

Charges on businesses importing vehicles are expected on 3 April, and taxes on parts are set to start in May or later.

Trump and members of his administration have argued that the tariffs will lead to "tremendous growth" and increase jobs in the US.

But experts and automakers have warned in dire terms that tariffs could raise prices for US consumers, amplifying the stress of an already sluggish economy.

Mohamad Husseini, co-owner of a used car dealership in Maryland, said that he expects the additional tariff costs to get passed on to the consumer.

"The prices in the wholesale market have skyrocketed already," he told the BBC.

"It's going to get worse."

A car that would sell for $13,000 (£10,000) might rise to $14,500 (£11,200) because of the tariffs, Mr Husseini said. He predicted that consumers will see prices increase in the next three to six weeks.

The auto tariffs will likely force car dealers like Mr Husseini to raise prices.

"We all still have bills to pay, mouths to feed and employees to pay," he said.

At another car dealership, Robin Sloan was hoping to get a deal before prices increased.

She said she probably would have waited until the summer to go car shopping, but "with the tariffs, I decided I should go out and look now".

She rejected the Trump administration's claim that tariffs will cause Americans to buy US cars instead of foreign ones.

"I don't think I would buy a car made in the United States just because of the tariffs, I think I would probably wait a few years until things settle down," Ms Sloan said.

From buyers to dealers, the effects of the tariffs will be widespread, for better or for worse, experts say.

In the US, there are 908 motor vehicles per 1,000 people. About 92% of households own a vehicle.

Car ownership is typically higher in the US than in Europe, surveys suggest, partly because, in the absence of extensive public transport, many Americans have no other choice of how to get around.

Cars are also more than just a means of transportation. As symbols of both freedom and success, cars have a unique place in the national identity, from the show Pimp My Ride to Janice Joplin singing "Oh Lord, won't you buy me a Mercedes Benz".

John Heitmann, a University of Dayton professor and automobile historian, who in his free time likes to polish his 1982 Mercedes SL, said that tariffs will have an existential, as well as an economic, impact.

"New cars are really out of the reach of a good number of Americans to begin with," he told the BBC.

"Consumers will not benefit, prices will go up," particularly amongst more affordable vehicles made in Korea, like Hyundais, he said.

As a vintage-car enthusiast, he said tariffs have added a layer of uncertainty to his hobby.

"About 50 minutes ago, I got an email from a part supplier in the UK saying, 'Don't worry... they're not going to go up, probably'," he said.

"'We haven't seen anything in writing yet.' That's what they said."

Higher-end imported vehicles, such as Audis, BMWs and Mercedes, will increase in price, too, Prof Heitmann said, though many of those who buy from such brands might be able to absorb a heftier price tag.

A 2024 study by the US International Trade Commission predicted that a 25% tariff on imports would reduce imports by almost 75%, while increasing average prices in the US by about 5%.

The US imported about eight million cars last year - accounting for about $240bn (£186bn) in trade and roughly half of overall sales.

Despite efforts from some car makers - including Ford and General Motors - to discourage Trump enacting auto tariffs, the president is forging ahead.

Some car makers are embracing Trump's tariffs, however.

On Tuesday, Hyundai, the South Korean car-marker, announced it would invest $21bn (£16.3bn) in the US by building a new steel plant in Louisiana.

Trump said the move is a "clear demonstration that tariffs very strongly work".

But the tariffs are likely to impact the domestic car industry as well.

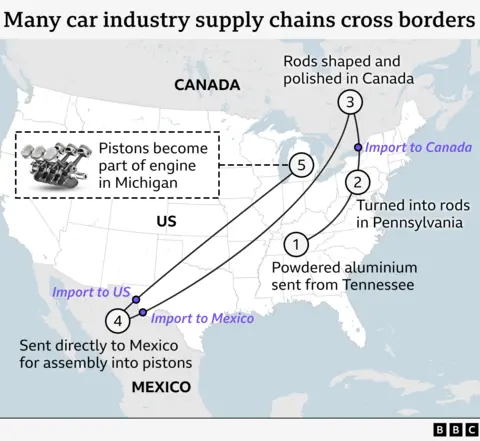

US auto manufacturing has been deeply intertwined with industries in Canada and Mexico for decades. Parts criss-cross the borders several times before they are assembled, which means that even a vehicle as iconically American as a Ford pickup truck could see a sticker price increase.

Ultimately, Trump's tariff strategy will thrust the US auto industry into uncharted territory, leaving uncertainty hanging over consumers, dealers and automakers until they go into effect on Wednesday.

"Everything's topsy turvy now, you know, and it's also terribly filled with uncertainty, because no one exactly knows what kind of game is really being played by the Trump administration related to all the bluster of these tariffs," Prof Heitmann said.

Some, like Mya Fountain-Bunch, just want to get through the unease. She took her car into a dealership this week to avoid needing a replacement after the tariffs hit.

"[I'm] making sure that my car is working and hopefully I won't have to buy another car in the next few years, or at least the next four years until this administration is done with."

Additional reporting by Meiying Wu