How many NI farms will be affected by tax changes?

Getty Images

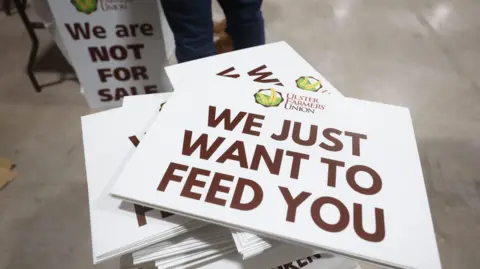

Getty ImagesThousands of farmers protested this week over changes to inheritance tax (IHT) announced in the Budget.

They say capping Agricultural Property Relief (APR) at £1m could end family farming in Northern Ireland and threaten food production.

But just how many farms here are likely to be affected?

What's it all about?

Pacemaker

PacemakerAPR began in 1984.

Since then, agricultural land and property – including farm buildings and houses – have been exempt from IHT.

This prevented farms being broken up and assets sold to pay a tax bill, an outcome that could potentially damage risk-taking and enterprise in what is seen as an important sector of the economy.

Another exemption - Business Property Relief (BPR) - applies for farm machinery, livestock and equipment.

Why are farmers protesting?

Getty Images

Getty ImagesIn the budget last month, the chancellor announced that both APR and BPR would be capped at a combined £1m with anything over that being taxed at 20%, half the normal rate of IHT.

The change will be introduced from April 2026.

What is the inheritance tax threshold?

The threshold sounds a lot, but land prices in Northern Ireland are, on average, almost £14,000 an acre and farms average at 100 acres.

This means the cap is quickly exceeded.

Ulster Bank's head of agriculture Cormac McKervey said land prices can differ wildly.

He said according to the Irish Farmers Journal, for all the farms sold in 2023, land with buildings on it was worth £18,000 an acre with quality of land also playing a factor.

Meanwhile, estate agent Libby Clarke said prices only ever increase.

"There's the old saying, they never make any more land, so land values have consistently been going up and the majority of buyers are farmers."

How many farms may be affected?

Getty Images

Getty ImagesAlmost three-quarters (73.7%) of Northern Ireland is farmed. Of the 26,131 farms here, 20,603 are described as "very small".

IHT only applies when the land is inherited, so it is difficult to predict how many farms may be affected every year.

But on a basic calculation using land with buildings, Mr McKervey said "many" could be in the IHT bracket.

A farmer with 100 acres would have land valued at £1.8m before including livestock or machinery.

That would leave them £800,000 over the threshold.

Mr McKervey said: "There are other reliefs and you may qualify, but if you assume you don't, then 20% inheritance tax is £160,000."

Meanwhile, research by Northern Ireland's Department of Agriculture, Environment and Rural Affairs (Daera) has indicated it would be "reasonable to assume" that agricultural land will be valued at about £15,000 per acre in 2026.

This means 27 hectares, or approximately 67 acres, would equate to an agricultural value of £1m, placing "around one third" of farms in the scope of inheritance tax.

A third equates to around 8,700 farms based on the 2023 farm census.

The dairy sector is hardest hit - about 75% of farms would be in the inheritance tax bracket.

The research adds that the £1m cap "does potentially bring a significant number of farms into the scope of inheritance tax and is much higher than the 4% to 7% of estates likely to be liable for inheritance tax generally over the forthcoming period".

What does the government say?

In her budget speech, Chancellor Rachel Reeves said she understood "the strongly held desire to pass down savings to children and grandchildren" and that she was taking "a balanced approach".

The Treasury estimates that across the UK, it expects 500 farms to be affected each year based on information from HMRC.

And it expects to raise an additional £230m in the first year of the change, rising to £520m in 2029/30.

A bid by the Department for Environment, Food and Rural Affairs to soften the changes was rejected by the Treasury.

Are there any other reliefs?

Tax law is notoriously complicated, so financial and legal advice is crucial.

Farmers get the same £325,000 IHT allowance that applies to everyone.

When it comes to the £1m cap on APR, there can be a cumulative effect if a farm passes from spouse to spouse to child, depending on how a will is constructed.

How to avoid inheritance tax

Land can be gifted, with the proviso the donor lives for seven years after the transfer is made.

If land is gifted between now and April 2026 and the donor dies during that time or within 7 years, the £1m cap on APR and BPR will still apply.

Farmers also have the option to pay an IHT bill over 10 years.

But Mr McKervey believes the requirement to keep investing in farms - to meet climate change obligations, environmental measures or farm quality criteria - means they will face a tough choice.

So what do you do?

Getty Images

Getty Images"Potentially you sell a portion of the land - that clears the tax bill but you're now left with a smaller, less productive, less sustainable business," said Mr McKervey.

"Or you might say, 'okay, the normal repair and maintenance that I might do on my farm each year, I'm going to stop that and divert the money to my tax bill'.

"Or the farmer comes to the bank and says, 'I have a tax bill of £160,000, so I want to borrow that money over 10 years'.

"The farm isn't generating any more profit because it's the same size it always was, but you now have £160,000, costing £20,000 or £22,000 a year with interest."

He has calculated the return on investment from 100 acres at £18,000 an acre as £34-36,000, which he says leaves "no room" to find the money.