Bank accounts locked and cash withdrawn after elderly gave power to law firm partner

BBC

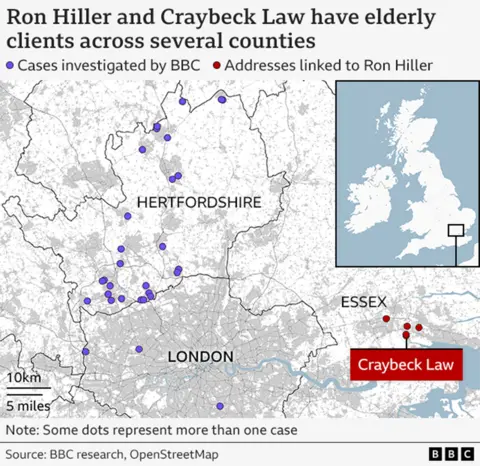

BBCElderly and vulnerable people in south-east England have told the BBC how they lost control of their money and property after dealing with a law firm based in Essex.

They described how they were persuaded - and sometimes felt under pressure - to grant lasting power of attorney (LPA) to a man called Ron Hiller, a partner in the firm.

LPA is a legal agreement in which someone appoints an "attorney" to make decisions on their behalf, either for finance or health and welfare.

Attorneys are supposed to act in their clients' best interests. But we investigated 30 cases involving Mr Hiller and his firm, Craybeck Law, and found a disturbing pattern of events:

- People found they had no access to their bank accounts and no idea how much Mr Hiller was charging for being their attorney

- Large amounts of cash were withdrawn without a reasonable explanation

- Properties were sold for what owners and others considered was lower than market value, and possessions were cleared and disposed of without owners' knowledge or informed consent

There has been a massive rise in LPAs in England and Wales in recent years. In 2023, more than one million people registered - a rise of 37% on the year before.

I spoke to dozens of vulnerable people, as well as their friends, family and neighbours, who expressed concern about Ron Hiller's business practices.

My findings also raise concerns about the potential lack of oversight within the system, and whether the body that regulates attorneys - the Office of the Public Guardian (OPG) - is able to deal with such problems.

A spokesperson for Craybeck Law has denied any wrongdoing but said the firm could not respond to claims about specific individuals, because of client confidentiality.

We made repeated attempts to speak to Mr Hiller in person, including at his home, but he did not respond.

Carole's story

Carole was in her 60s, living alone in a house in Uxbridge, west London.

In April 2022 she was admitted to hospital with an infection. She never came back.

Her friends and neighbours, Bert and Hazel, wanted to visit her in hospital but Covid restrictions were in place. Then the hospital told them she had been transferred to a care home.

They rang the home repeatedly but were never put through. They left messages but their calls were not returned.

Within months, Carole's house had been completely cleared out and sold for £355,000 - a low price, the neighbours thought, considering other houses in the street were fetching up to half a million.

Hazel and Bert were worried about what was happening, but they had no legal right to know any more details.

They wrote asking for my help, as they knew I had investigated a similar case.

I managed to track down Sandie, Carole's cousin.

Together we paid a visit to Carole's care home in the Hertfordshire town of Rickmansworth.

Carole told us she was desperate to leave, but was stuck there. She said she had been introduced to Ron Hiller at the care home, and he had convinced her to grant him lasting power of attorney over her finances.

Most people appoint family members to be their attorney but for Carole, this had not been an option. Her closest relative was Sandie - however, she lived about a 100-mile drive away and suffered from serious health problems.

A property and finance LPA can be activated as soon as it is registered. Carole told us she had been in a lot of pain when she arrived at the care home, and her LPA shows she agreed to grant these powers to Mr Hiller straight away.

Since that point, she had been without her bank cards and had received no statements. She was also in the dark about how much she was paying Mr Hiller to manage her finances.

She had wanted to call Hazel and Bert, but Mr Hiller had given her a new phone that didn't contain any of her old contacts.

Carole told us he had advised her to sell her house in order to pay the care home fees, then later told her it had fetched a low price because nobody had wanted to buy in her area.

As we sat talking, Sandie looked at her phone and discovered the house was on the market again. This time, the asking price was almost £100,000 more than when Mr Hiller had sold it for Carole.

After meeting Carole in the care home, Sandie asked for detailed accounts from Craybeck Law.

What came was a slow drip-feed of bank statements, with no real explanation of Mr Hiller's charges and hardly any receipts.

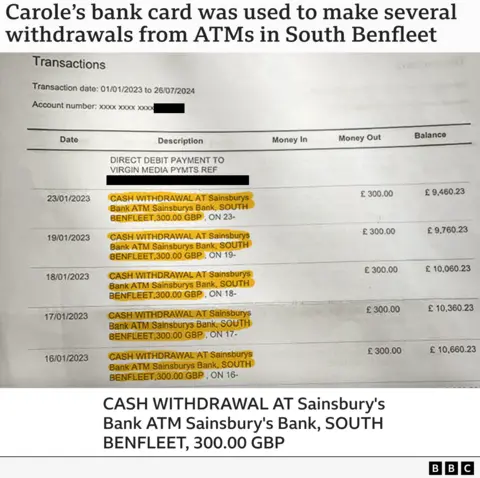

However, they did show that large sums of money had been taken from Carole's account. Her bank card had been used to make a series of £300 cash withdrawals from ATMs in the Essex town of South Benfleet, near Mr Hiller's office.

He told Sandie that Carole had authorised the withdrawals - but later, when Carole asked to see invoices, they were not produced.

The statements also showed a charge for arranging for Carole's house to be cleared. I later discovered the work was given to Silverback Commerical Removals, and that the director of this firm was David James Hiller - the son of Ron Hiller.

Craybeck Law denied there was any conflict of interest and said the decision to use Silverback was reached after quotes were sought from alternative providers. Carole has no record of these.

I heard a similar story about house sales a few miles away in Watford.

Ron Hiller was appointed to oversee the finances of an elderly woman called Elizabeth - her house had been sold for £350,000 after she went to live in a care home.

It was then left empty and sold on a few months later for £525,000 - without any signs that improvements had taken place.

Craybeck Law said it would not comment on individual cases but told us that the properties it handled were often in poor condition and that sometimes they needed to be sold quickly to cover care home fees, and "to avoid the risk of a sale falling through".

Under pressure?

Many of the people I spoke to, felt Ron Hiller had put them under pressure to appoint him as attorney.

Some also told me they had been introduced to him by care professionals, who had led them to believe he was a qualified solicitor.

On the website for Craybeck Law, Ron Hiller is described as a partner in the firm's elder client division. However, the letters after his name - MCICM - denote a diploma in credit management and debt collection.

There is no mention of Ron Hiller on the official register of qualified solicitors either.

A spokesperson for Craybeck Law denied Mr Hiller had ever given the impression he was a qualified solicitor. They added that changes to the law in 2008 meant that individuals who were not qualified solicitors were permitted to become partners in law firms.

In the Hertfordshire town of Letchworth, a woman called Petra told me how an NHS social worker called Margaret Falegan had brought Mr Hiller to her house during a professional visit.

Petra suffers from anxiety and had previously told Ms Falegan - whom she described as her mental health nurse - that she was having trouble with her bills.

She felt she was being put "very much" under pressure to grant Mr Hiller power of attorney, even though she felt uneasy about him.

The next day, she went to her local Citizens Advice Bureau and - with the help of the staff there - suspended the process.

A few weeks later, she received a letter from Mr Hiller. It read: "I've informed the mental health team, Stevenage, of your decision, as this may impact on the level of support they may have planned to provide you in the future."

Whatever Mr Hiller had meant by this, Petra read it as a threat. She told me she was still upset about the letter months later, and it had destroyed her trust in the mental health team.

I have heard of other cases where Margaret Falegan introduced Mr Hiller to potential clients in the course of her professional duties. In one, the appointment was made in spite of objections from the man's relatives that he had dementia and did not understand what he was signing.

When I approached Ms Falegan for a response, she denied putting pressure on her clients to sign with Mr Hiller. However, she did not say whether her employer, Hertfordshire Partnership University NHS Foundation Trust (HPUFT), knew that he had accompanied her on client visits.

In response to my findings, HPUFT said it had now launched an investigation into Ms Falegan, as well as other social workers who had introduced Ron Hiller to clients. The trust said it had also raised the matter with the appropriate professional bodies and the police.

"If an NHS or care worker is making introductions between their clients and potential attorneys that is very concerning," says consultant psychiatrist James Warner.

"If [elderly or vulnerable people] don't have the ability to decide who they want to appoint as their attorneys, they shouldn't be appointing attorneys."

Craybeck Law said that when a potential client was introduced to the firm, a qualified individual - usually a social worker - would have a discussion with that person, to ensure they had the mental capacity to make the decision to appoint the firm as their attorney.

They said this would take place without a Craybeck Law representative present.

It also said the firm had processes to ensure that no individual felt coerced into signing powers of attorney.

Wills

In several of the cases I looked at, Craybeck Law - and chiefly Ron Hiller - not only acted as attorney but also executor of clients' wills.

An executor is legally responsible for carrying out the instructions in a person's will and handling their estate.

However, in at least two cases, Mr Hiller seems to have ignored the instructions he was given. One client was surprised when I told her that the will he had drawn up for her split her estate between four charities - including one she had never heard of.

Another client told me he had not seen a copy of a will Mr Hiller had drawn up for him, and did not understand its contents.

Valerie in Borehamwood also appointed Mr Hiller as attorney and executor of her will. After she died in 2022, it emerged that her family had been left out of her will and her entire estate - estimated at about £220,000 - was left to a police charity.

Her brother and sister-in-law, John and Kaye, live in Australia and were not well-placed to challenge the will. The fact that family members were no longer beneficiaries also meant they were not entitled to any financial information.

"We couldn't see how much [Ron Hiller] was charging for probate or how much he charged every year for being her power of attorney," Kaye told me.

Ann Stanyer, a leading lawyer in this field, told me that if an attorney is also the executor of a will, there is much less scope for proper scrutiny: "They can both operate the powers of attorney during their lifetime and take fees through that, but they can then take big fees from the estate as well."

Craybeck Law said that the firm was governed by the Solicitors Regulation Authority's (SRA) rules and principles, including strict conduct and ethical guidelines that it upheld.

It said that much of what had been put to it was inaccurate and based on second- or third-hand hearsay and that it fully refuted the insinuations made about the way it supported its clients.

The SRA has now confirmed it is looking into allegations made in this article.

Moving on

Carole has now moved out of the care home in Rickmansworth, and into a small flat in Folkestone near her cousin Sandy.

She has the added work and expense of buying all the basics for her new home, because Ron Hiller disposed of all her furniture and most of her possessions.

However, she is happy to be making a fresh start.

Her story, and the others in this article, were only a few of those I heard about Ron Hiller. He has acted as attorney for scores of people - a fact that Ann Stanyer finds odd.

"You've got to run [LPA] properly and you can't possibly do that if you've got volumes of these things," she says. "I have four or five which are active and that's more than enough."

The Office of the Public Guardian doesn't appear to track when an attorney has an unusually large number of clients. A former senior judge at the Court of Protection, Denzil Lush, is concerned that the OPG is not designed to spot potential problems with the system.

For instance, if an attorney's powers are revoked by more than one of their clients, the OPG does not automatically look at why this is happening.

The issue has caught the attention of Parliament - a private members bill, which has gone to its second reading, proposes greater safeguards.

Many MPs feel it is an urgent problem because of the sheer numbers involved. More than eight million people in England and Wales have now registered an attorney to act for them.

The system was designed to protect elderly and vulnerable people, but the danger is that without better safeguards, it could be leaving them open to harm.

Additional reporting by Ben Milne