Budget 2024: Five things Surrey should watch out for

Getty Images

Getty ImagesChancellor Rachel Reeves will present her tax and spending plans in the House of Commons on Wednesday.

So how might this year's Budget affect people in Surrey?

Here are five things to look out for.

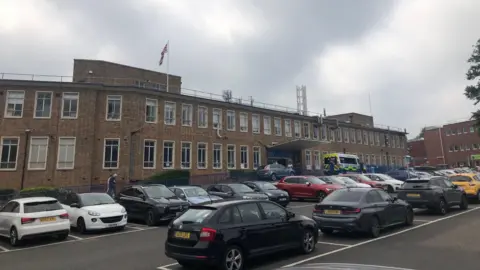

Plans to build new hospitals

In July, Labour announced a review of the plan to build 40 extra hospitals by 2030, as part of measures to address a £22bn black hole in the country's finances.

The New Hospitals Programme includes a new facility in south London to replace healthcare services at Epsom and St Helier hospitals.

Some of the buildings at both sites have previously been described as “crumbling” and older than the NHS.

MPs in Surrey have said it is “vital” that the rebuilding project should still go ahead.

SEND funding

At Prime Minister's Questions just before the Budget, the Liberal Democrat MP for Esher and Walton, Monica Harding, urged the government to “properly” fund special educational needs and disabilities (Send).

Other MPs have raised concerns that many parents are struggling to get support for their children and the leader of Surrey County Council has apologised to families who have been let down over their provision.

Deputy Prime Minister, Angela Rayner, said she was sure the Chancellor had “heard” what had been said on the issue.

Inheritance tax

The BBC has learned that the government is planning to increase the amount of money it raises in inheritance tax, which is charged at 40% on the property, possessions and money of somebody who has died above the £325,000 threshold.

It is not known how many people are likely to end up paying more, nor how much more they would pay.

London and the South East has the highest number of estates liable for the tax each year.

In 2018, Guildford was named as the "inheritance tax capital" of the UK.

Getty Images

Getty ImagesStamp duty

Rachel Reeves is expected to allow the Stamp Duty thresholds to fall to levels set before Liz Truss' mini-Budget.

The tax is due if you buy a property or land over a certain price.

In 2022 the threshold was increased to £250,000 (£425,000 for first-time buyers), but the Chancellor may well lower it again.

With Surrey being one of the most expensive places in the UK to buy a home, there will be questions over the impact on the local property market.

VAT on private school fees

The government has already said a 20% VAT rate will be added to private school fees from 1 January 2025, with ministers arguing the increase is needed to help fund 6,500 new teachers in England.

In 2021–2022, just under one in five children in Surrey went to a private school - a higher proportion of pupils than other parts of the country.

Surrey’s six Conservative MPs have said families of children with special educational needs should be exempt from the plans, according to the Local Democracy Reporting Service.

Follow BBC Surrey on Facebook, and on X. Send your story ideas to [email protected] or WhatsApp us on 08081 002250.