Child Trust Funds worth billions unclaimed: 'I got £955'

BBC

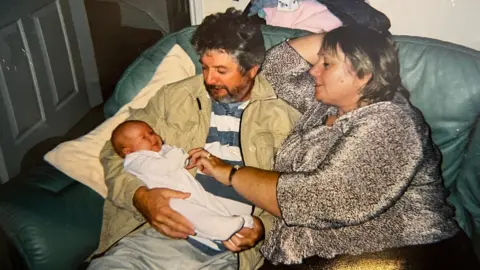

BBCLatonya Skye-Paterson had no idea a Child Trust Fund had been set up for her until her college tutor suggested she check online.

"I found I had £955 in there, which is a lot. A lot more than I was expecting... it helped me so much," she said.

New figures suggest £1.4 billion belonging to 728,000 people is ready to be claimed now they have turned 18 - but many do not know the accounts exist, according to a charity that traces lost funds.

Now a senior MP is backing calls for pay-outs to be made automatically for some of these accounts - a plan the government says would be complex and costly.

Latonya, 20, is one of 6.3m people born between Sept 2002 and Jan 2011 who had a child trust fund kick started by a payment, usually £250, from the government.

The idea was the long-term tax-free savings pot would go up in value by their 18th birthdays.

The average amount in Child Trust Funds is estimated to be around £2,000 because of growth over the years and extra money put in by family and friends.

But like hundreds of thousands of others, when Latonya turned 18 she had no idea her fund existed.

The Share Foundation, a charity which helps people track down lost and unclaimed funds, is calling for automatic pay-outs for some of these funds if they've not been claimed by the time account holders turn 21.

"I think it's a great plan to be honest," said Latonya. "My college tutor told me about it but my brother is a year older and went to the same college and he wasn't told about it so it's luck of the draw who knows, who tells who.

"Especially with cost of living, getting it automatically when you didn't know you had it could really give people a break that they need."

This "default withdrawal at 21" plan covers accounts where no action was taken by parents or carers to set up a trust fund after being sent the initial voucher from government.

These "lost" funds are called "HMRC allocated accounts" and number 449,000 accounts holding £927m.

It is these funds which campaigners are calling to be automatically paid to account holders using National Insurance numbers if they're not claimed by the time people turn 21 years old.

The National Insurance numbers could be used to trace account holders via PAYE payslips, student loans or benefits.

'Treasure trove'

Sir Geoffrey Clifton-Brown is an MP who also chairs Parliament's Public Accounts Committee.

Speaking in his role as an MP he told Radio 4's Money Box he backs the automatic pay-out idea.

"I liken this money a bit to a treasure trove buried on a [desert] island in vast acres of sand expecting the poor recipients on these child trust funds to go and find this money," he said.

"I think there's a lot more we could do to encourage the government to find the recipients."

Sir Geoffrey said he'd be pressing the Treasury and HMRC next time they appear in front of the Public Accounts Committee on this issue.

UK Parliament

UK ParliamentHMRC said it was grateful for the suggestion of the "default withdrawal at 21" plan from The Share Foundation but said the proposal was complex and could not be implemented easily.

"For HMRC to close these accounts, obtain the savings in those accounts and transfer them with or without the owner's consent would require careful legal consideration," a spokesperson said.

They added the move would also require "operational systems and resources" across government departments and Child Trust Fund providers to monitor the transactions.

"The government is committed to reuniting all young adults with their CTFs and recognises the importance of ensuring that young adults can benefit from these funds as they reach adulthood."

How to trace a Child Trust Fund

Child Trust Funds can be found using the Government Gateway service, which requires a login or registration. The Child Trust Fund unique reference number, or national insurance number is also needed.

The Share Foundation charity runs a free finding service.

More information on Child Trust Funds is available on through the government-backed Money and Pensions Service.