House prices at record high, says Halifax

Getty Images

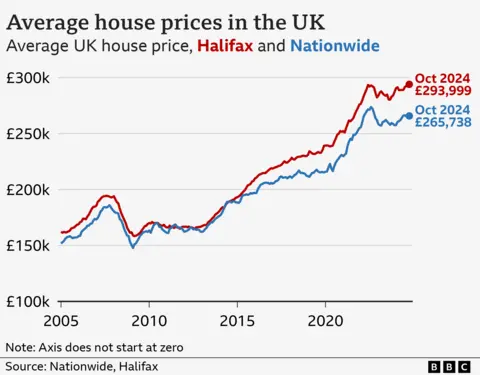

Getty ImagesThe average UK house price reached a record high last month, according to Halifax.

The UK's largest mortgage lender said the average price hit £293,999 in October, surpassing a peak of £293,507 that was reached in June 2022.

Halifax said it expected prices to continue to rise at a "modest pace" for the next few months.

However, it warned that mortgage costs could remain "higher for longer" following last week's Budget.

Following the Budget, which included plans to borrow and spend billions of pounds, financial markets expect the Bank of England to cut rates more slowly than previously anticipated.

The Bank cut its key rate to 4.75% from 5% as expected on Thursday.

Following its decision, Bank governor Andrew Bailey said that interest rates would "continue to fall gradually from here”.

However, he cautioned that "we can’t cut interest rates too quickly or by too much" on order to keep inflation close to its 2% target.

Halifax said house prices edged up by 0.2% in October, meaning property values have now increased for four months in a row.

House prices are up 3.9% from a year earlier, Halifax said, which is a slight decrease from the 4.6% annual increase seen in September.

Commenting on the new record high, Amanda Bryden, head of mortgages at Halifax, said: “That house prices have reached these heights again in the current economic climate may come as a surprise to many, but perhaps more noteworthy is that they didn’t fall very far in the first place.

"Despite the headwind of higher interest rates, house prices have mostly levelled off over the past two and a half years, recording a +0.2% increase overall."

She added that Budget announcements such as higher stamp duty for second home buyers and a return to previous thresholds for first-time buyers could hit demand for properties.

However, she added that market activity had been improving, with the number of new mortgages agreed recently hitting the highest level for two years.

At the moment, you do not pay stamp duty when buying a property worth less than £250,000. This was doubled from £125,000 under Liz Truss' mini-Budget in September 2022.

If you're a first time buyer you do not pay stamp duty on homes worth up to £425,000 after this threshold was raised from £300,000.

These higher thresholds will revert to previous levels in March 2025.

David Stirling, an independent financial adviser at Mint Mortgages & Protection, said: "Estate agents are busy even in a higher interest rate environment and mortgage applications and approvals are still strong."

Where are prices rising the fastest?

London remains the most expensive place in the UK to buy a house.

The average property there now costs £543,308, which is up 3.5% compared to last year, the Halifax said.

Northern Ireland has maintained its record for the strongest annual house price growth in the UK.

The average price of a property there is now £204,242.

In England, the North West region saw the strongest growth with prices up 5.9% over the last year making the average house cost £235,587.

House prices in Wales also saw a strong growth, up 5.6% compared to last year, with homes now costing an average of £225,543.

In Scotland, a typical property now costs £206,480, which is up 1.9% compared to 2023.

Ways to make your mortgage more affordable

- Make overpayments. If you still have some time on a low fixed-rate deal, you might be able to pay more now to save later.

- Move to an interest-only mortgage. It can keep your monthly payments affordable although you won't be paying off the debt accrued when purchasing your house.

- Extend the life of your mortgage. The typical mortgage term is 25 years, but 30 and even 40-year terms are now available.