UK mortgage lenders cut rates after Trump tariffs

Getty Images

Getty ImagesA growing number of UK lenders are cutting mortgage rates as the fallout from US tariffs continues to fuel forecasts of deeper than expected interest rate cuts.

Coventry Building Society became the largest mortgage provider to trim its two-year fixed rate mortgage to below 4% on Wednesday, joining a number of lenders who made similar moves.

Financial markets and economists are predicting that the Bank of England will reduce borrowing costs by more than expected this year to avoid a downturn.

The risk of global economic instability has grown after Donald Trump pressed ahead with trade taxes on US imports from more than 60 countries.

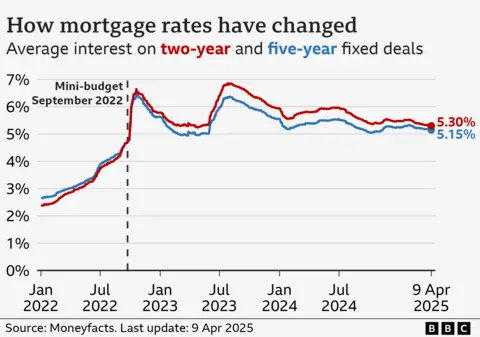

According to the financial data company Moneyfacts, the average two-year fixed mortgage rate ticked down to 5.3%. The average five-year fix edged lower to 5.15%

Coventry Building Society is lowering its two-year fixed rate deal to 3.89% to the end of October 2027.

Head of mortgage relations at Coventry, Jonathan Stinton, said there is "growing demand for shorter-term flexibility in an uncertain market".

However, the product is only for borrowers with a 65% loan-to-value and comes with a £999 fee.

Clydesdale Bank and Newcastle Building Society have also cut their rates.

But despite the recent falls, many mortgage holders coming off fixed deals signed before interest rates started rising in mid-2021 are likely to face a more expensive loan when they refinance.

Around 1.3 million homeowners will see their existing fixed-rate deals end between April and December this year, according to figures from the Financial Conduct Authority.

Meanwhile, the Co-operative Bank will cut its two-year, three-year, and five-year fixed rates on certain purchase mortgages by 0.14 percentage points on Thursday.

TSB, Metro and Bank of Ireland are among those who have cut rates since the start of this week.

Brokers expect further falls in the coming days as the "Big Six" lenders - Halifax, Nationwide, HSBC, Santander, Lloyds, and Natwest - continue to adopt a "wait and see" approach by so far not announcing any cuts.

When they drop rates, brokers say other lenders tend to follow.

Central banks cut interest rates in response to concerns of an economic downturn in the hope that cheaper borrowing will encourage more spending.

On Wednesday, the consensus among economists was that there will be four Bank of England rate cuts over the next 12 months. At the start of the week the consensus was just two.

A Nationwide spokesperson told the BBC: "We keep our fixed mortgage rates under regular review, and we have already made a number of rate cuts over the last couple of months."

Rachel Springall from Moneyfacts said it "traditionally takes a couple of weeks for lenders to respond to swap market volatility".