Reeves' China trip defended after borrowing cost nerves

PA Media

PA MediaIt is "absolutely right" that Chancellor Rachel Reeves' trip to China goes ahead as planned, a cabinet colleague has said.

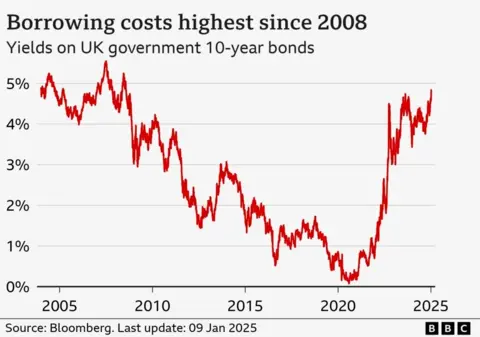

Opposition parties had called for Reeves to cancel the three-day visit, aimed to boost trade and economic ties, after the pound fell to its lowest level in over a year, while UK borrowing costs hit their highest for 16 years.

But Culture Secretary Lisa Nandy said the chancellor should take seriously the UK's relationship with China, the world's second largest economy.

Nandy said the rise in borrowing costs was "a global trend that we've seen affecting economies all over the world".

"We are confident that we're taking both the short-term action to stabilise the economy but also the long-term action that is necessary to get the economy growing again," she told the BBC.

Higher government borrowing costs have led to fears that further tax rises or spending cuts could be on the horizon as the government tries to meet its self-imposed rule not to borrow to fund day-to-day spending.

Lower-than-expected spending on public services could affect things like health, education and welfare.

Government borrowing costs, which have been rising in recent months, climbed again on Friday.

The pound, which fell to its lowest level in more than a year on Thursday, also dipped at the market open.

Analysts say it is unusual for those two things to happen together but suggest wider concerns about the strength of the UK economy had driven the pound lower.

On Thursday, the Treasury ruled out any emergency intervention in the markets, saying they continued to "function in an orderly way".

Globally, there has been a rise in the cost of government borrowing in recent months sparked by investor concerns that US President-elect Donald Trump's plans to impose new tariffs on imports from Canada, Mexico and China would push up inflation.

UK government bonds - known as "gilts" and which the goverment uses to raise money - are normally considered very safe, with little risk the money will not be repaid. They are mainly bought by financial institutions, such as pension funds.

Interest rates - known as the yield - on government bonds have been going up since around August.

Sir John Gieve, former deputy governor of the Bank of England, told the BBC what was happening to long-term yields in the UK reflected what was happening to yields in the US.

"[In] the US, markets are taking a different view of how their economy is going to go once President Trump is in office and their rates have gone up to 4.75% on 10-year Treasuries and ours have gone up in parallel to that. So I don't think this is a response to something we've done," he said.

Travelling to China with the chancellor are senior financial figures, including the governor of the Bank of England and the chair of HSBC.

There she will meet China's Vice Premier He Lifeng in Beijing before flying to Shanghai for discussion with UK firms operating in China.

The government is looking to revive an annual economic dialogue with China that has not been held since the pandemic.

Ties have been strained in recent years by growing concerns about the actions of China's Communist leaders, allegations of Chinese hacking and spying and its jailing of pro-democracy figures in Hong Kong.

The Conservatives and Liberal Democrats have criticised the chancellor for proceeding with the planned trip rather than staying in the UK to address the cost of government borrowing and slide in the value of the pound.

Shadow chancellor Mel Stride accused Reeves of being "missing in action".

Governments generally spend more than they raise in tax so they borrow money to fill the gap, usually by selling bonds to investors.

The yield on a 10-year bond has surged to its highest level since 2008, while the yield on a 30-year bond is at its highest since 1998, meaning it costs the government more to borrow over the long term.

Reeves has previously committed to only one fiscal event a year - where she can raise taxes - which would likely be in a Budget in the autumn.

If she needs more money before that, a squeeze on spending is more likely.

On 26 March the government's independent forecaster will put out its latest projections for the economy and will say whether the chancellor is likely to meet her fiscal rules.

A spending review, which sets government department spending, will follow in June.

"The Treasury has come forward and tried to reassure markets by saying we've got new fiscal rules and we're definitely going to stick to those, but it's becoming clearer and clearer that that's going to be very difficult," Sir John Gieve said.

He said it would require difficult decisions from the chancellor in the spending review and then the Budget.

"The choice she's going to face... is can I raise borrowing - and the increase in interest rates that's happened now, if it continues, will decrease her scope for doing that within her rules - or do I increase taxes again, or do I actually institute some very severe reductions and squeezes on public services."

Sign up for our Politics Essential newsletter to read top political analysis, gain insight from across the UK and stay up to speed with the big moments. It'll be delivered straight to your inbox every weekday.