'It's going to have to go', says car owner as insurance rises

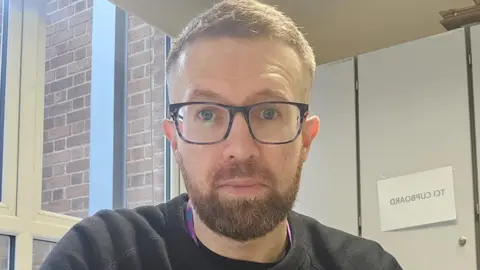

Darragh Statham

Darragh StathamA car owner from Northern Ireland fears he may have to sell his vehicle due to the soaring costs of car insurance.

"Despite the fact that I love the wee car, it's going to have to go," Darragh Statham told BBC News NI.

Research from the Office for National Statistics shows that in the last financial year, motor insurance premiums rose by 42%.

It comes as a government taskforce is set up to tackle the issue, but Ulster Unionist Party MP Robin Swann has stressed Northern Ireland must not be “an afterthought”.

"If there are bespoke issues in Northern Ireland they need tackled as equally as those issues that are affecting the rest of the United Kingdom," he told BBC News NI's Good Morning Ulster.

'There's no justification'

Darragh Statham was quoted around £1,500 to insure two cars, one for himself and one for his partner.

He said he may be forced to sell one of the cars if his insurer doesn't bring the price down.

"Despite the fact that I love the wee car, it's going to have to go," he said.

Mr Statham added that clarification is needed on why insurance costs are rising.

"If you have no claims, why is your insurance going up? You should be less of a risk. There's no justification apart from: 'Everything's going up.'

"No one can say why."

PA Media

PA MediaLaunching the taskforce, Transport Secretary Louise Haigh described car insurance as "an essential, not a luxury".

She added that the government is "committed to getting costs under control".

The taskforce will bring together industry experts, consumer champions and regulators to crack down on the spiralling costs of car insurance.

Swann has called for the group to take an "in-depth look" to ensure the reasons given by insurance providers for increasing premiums are valid.

"I'm talking to people who are seeing their insurance premiums not just double but quadruple at times," he said.

"I'm talking to new car drivers who are now looking at insurance premiums that are two or three times the price of the car.

"So insurance is putting young people and older people off our roads."

Some readers have been getting in touch with BBC NI, including Hugh Finlay, 86, who has traded in his car for a mobility scooter after he was quoted £1,050 for car insurance, more than triple what he was paying in 2021.

Mr Finlay said the switch has “saved me a lot of money" but added: “I miss my car very much."

Describing the situation a “disgrace”, another reader called Michael explained that he had been quoted £2,200 to renew his policy that also included his wife and daughter - double the cost of their insurance two years ago.

Stephen Barnes, from County Down, said his insurance has risen from £340 to over £700 despite having no claims or accidents in almost four decades.

Owning a car is essential for NHS domiciliary care worker Niall, from Londonderry, but he is unhappy that he is paying more for insurance now than he was 20 years ago.

The 53-year-old is paying almost £600 this year, up from £420 and he had been quoted around £1,500 by some companies.

Colette Quinn

Colette QuinnColette Quinn, who has been driving for over 45 years, received a range of car insurance quotes when shopping around after her insurance increased by almost £100.

Her quotes ranged from £225 to £560.

She said she was "shocked" by the prices, particularly given her no claims bonus and low mileage.

Her existing insurance provider didn't give a reason for the increase and she was told that "this is just the way things are".

"For the amount of money you're paying, they should be in some way accountable to you," she said.

While Ms Quinn's insurance provider did eventually bring her premium down, she said the process is a "time-consuming" one to have to go through every year to get the best deal.

She said the taskforce should look into the reasons for insurance hikes and why renewal quotes can be reduced when people query them.

Why is car insurance so expensive?

Factors driving up the cost of insurance include inflation, rising car thefts, the cost of parts and labour and pothole-ridden roads.

Mark Shepherd, head of general insurance policy at the Association of British Insurers, told BBC News NI's Good Morning Ulster that the industry is also "seeing the impact of increasingly sophisticated vehicles" which are more expensive to repair.

Mr Shepherd highlighted an Ernst & Young analysis from 2023 which found insurers paid out £1.13 in claims and expenses for every £1 of premium they took in.

"Clearly that is not going to last as a sustainable market," he said.

"That's why we're having issues with competition because it's not profitable for insurers to continue on that basis.

"That's why premiums have had to rise. We're hopeful that in 2024 that will change and more profit will be made but that's a massive challenge for the market."

Northern Ireland factors

According to Robin Swann, a lack of competition in the market seems to be more of an issue in Northern Ireland than other parts of the UK.

He welcomed the Competiton and Markets Authority's inclusion in the taskforce, adding that they "can get down into the detail... of the market and make sure there is a breadth of providers".

Shepherd added that Northern Ireland has a "higher proportionate rate of deaths and serious injuries from road collisions than the rest of the UK", which has an impact on insurance costs.

He said another factor is that Northern Ireland has higher rates of compensation for minor injuries resulting from road traffic accidents.

This is because legislation introduced in England and Wales to implement fixed compensation tariffs hasn't been brought in in Northern Ireland.

Insurance premiums could fall by around £90

Meanwhile, a review concerning personal injury claims could soon see typical car insurance premiums in NI fall by around £90.

The government review looked at the the investment returns a claimant could generate from investing a compensation payment over a lifetime.

As interest rates were very low between 2009 and 2021 the assumption was that investment returns would also be low meaning that the size of lump sum payouts needed to be higher.

Now as interest rates have moved higher the assumption is that claimants will get an equivalent level of benefit from a lower lump sum.

That in turn should mean insurance companies are able to reduce premiums for their wider customer base.

Mohammad Khan, head of general insurance at PwC UK said: "Northern Irish drivers will be happy to see their premiums fall, and drivers under the age of 30 - who typically have the most expensive policies - should benefit from the most significant savings.”