Benefits falling behind rising cost of living

Getty Images

Getty ImagesBenefit rises among the UK's poorest are failing to keep up with the cost of living, new figures suggest.

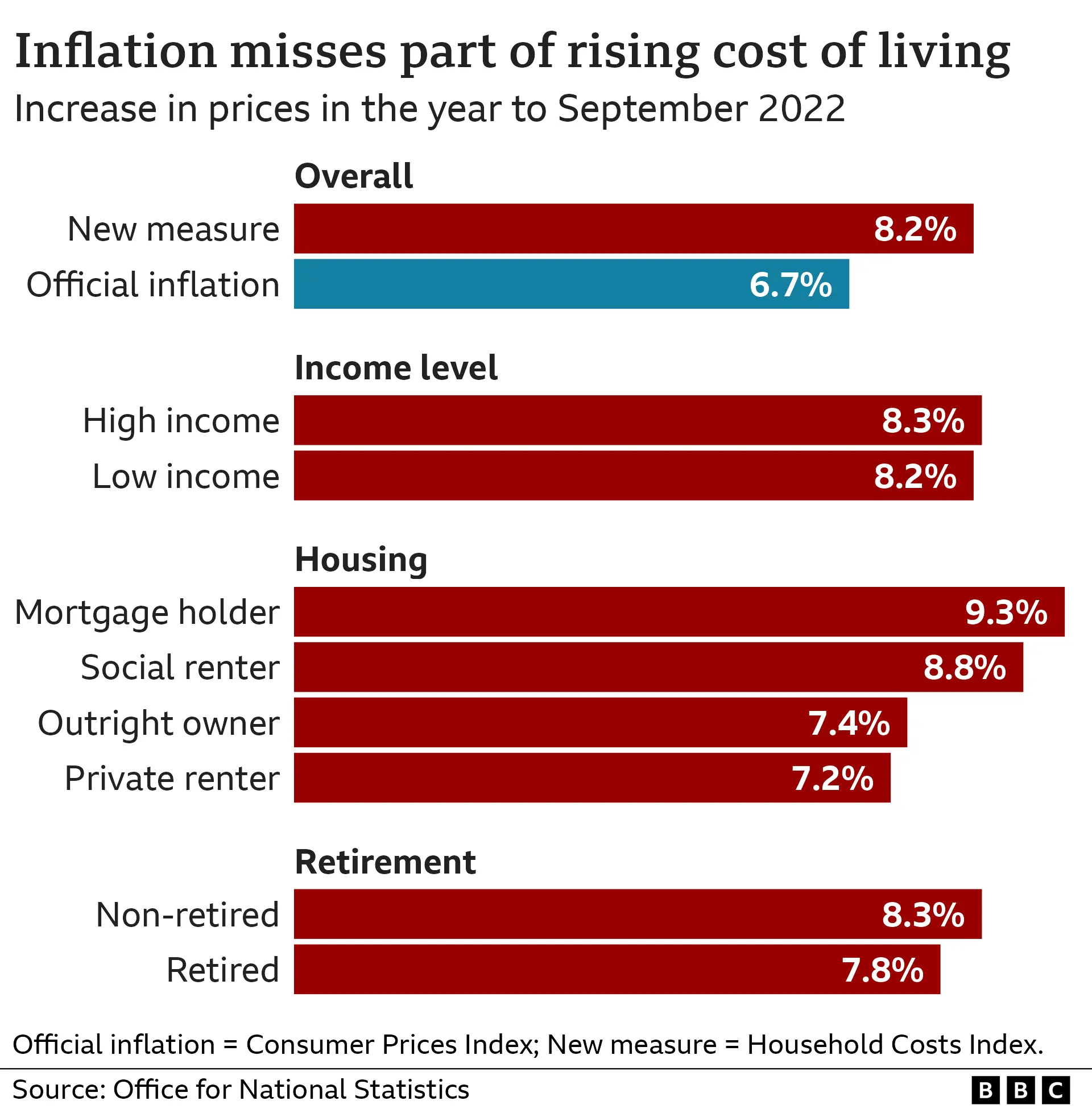

In the year to September, the cost of living rose by 8.2% among the poorest, compared with a 6.7% rise in benefits.

This difference might be worth roughly an extra £15 a month to a family receiving £900 in universal credit.

"We've had two years of ministers really wanting to maintain benefits in real terms," said Morgan Wild of the Citizens Advice Bureau.

"But they haven't been given the tools to do so, so have unintentionally cut them."

Working-age benefits in the UK are increased each spring by the inflation figure recorded the previous September.

Inflation is the increase in the price of something over time.

For example, if a bottle of milk costs £1 but rises to £1.05 a year later, then annual milk inflation is 5%.

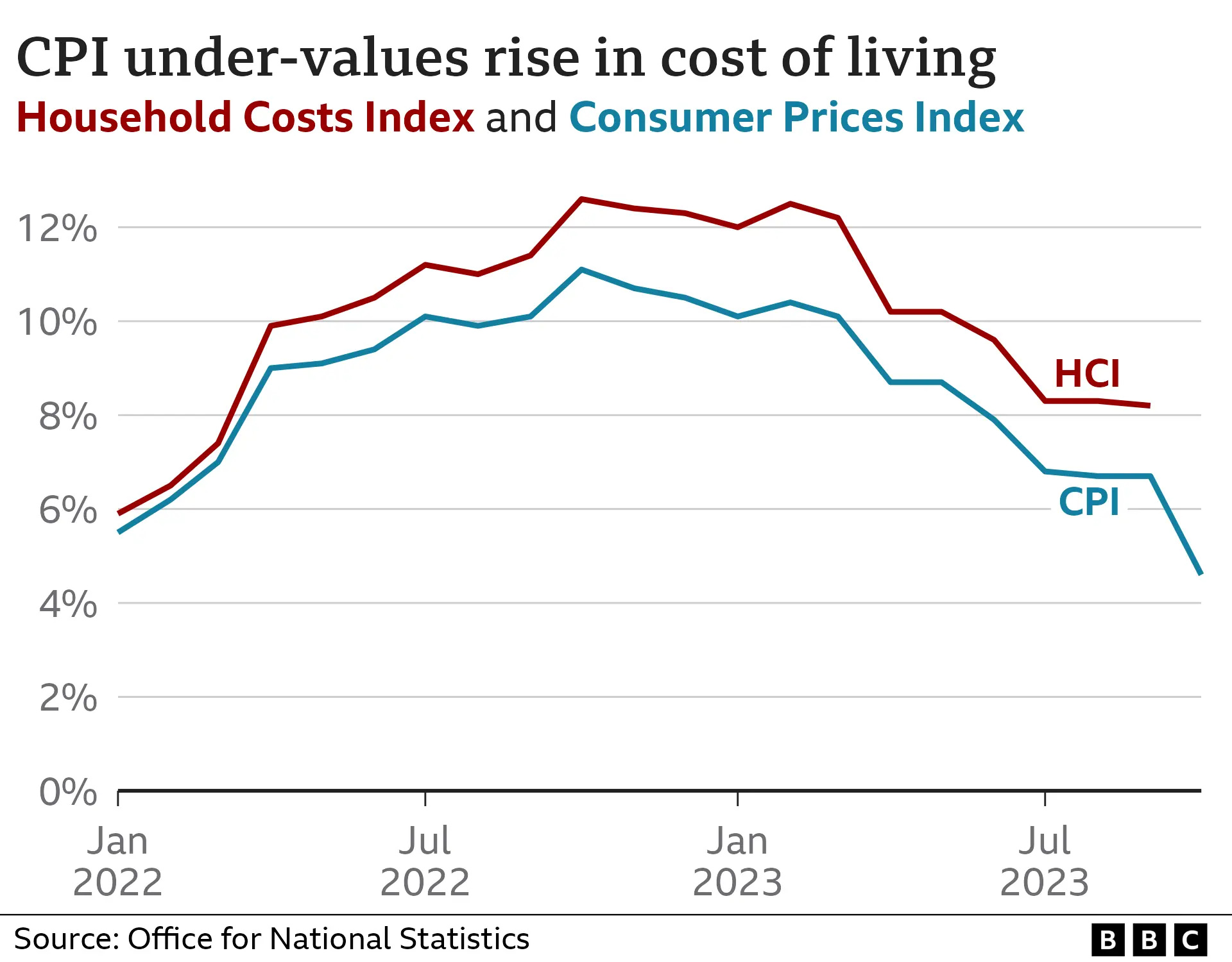

However, the UK's main measure of inflation - known as the Consumer Prices Index (CPI) - ignores some of the costs that have been rising for British households.

For example, it does not include interest payments on credit cards or mortgages.

These things are not included because CPI is designed for policymakers who set interest rates to target inflation, rather than to measure the cost of living.

CPI also gives less weight to poorer families, who have been hit hardest by rising food and energy bills because they spend a bigger share of their money on those things.

"For quite some time, the official figures just haven't been telling their story of the people who come to us for help," says Mr Wild.

To address this, the Office for National Statistics (ONS) has been developing a new measure - called the Household Costs Index (HCI) - that tries to better capture the true rises in the cost of living for different groups in society.

It estimates that, in the year to September, the cost of living for the average family rose by 8.2%, which is higher than the 6.7% recorded by CPI.

"The data shows exactly why we've been pushing for development of the HCIs," said Jill Leyland from the Royal Statistical Society.

"CPI is fine for broader economic purposes but over the past two years, it has not reflected the true extent of the cost of living crisis."

Renters v mortgage holders

The ONS also looked at cost of living rises for different groups.

Its analysis suggested that households with a mortgage faced the quickest increases in their cost of living out of all the groups studied, with their cost of living up by more than 9%.

While private renters faced a lower increase in their costs - at 7.2% - it is still significantly higher compared with recent years.

Renters also pay a larger share of their income on housing than homeowners.

Income groups

There was not much difference between the lowest income and highest income households in the latest figures.

However, last autumn, low-income households were seeing an inflation rate two percentage points higher than high-income households.

Back then, they were being hit harder than other types of household by steep rises in energy bills.

But throughout 2023, the gap has closed as interest rates have fed through into higher mortgage payments, which have a bigger effect on middle and higher income families.

Additional reporting by Nicu Calcea