What do government's tax changes mean for me?

PA Media

PA MediaThe government has dropped its plan to abolish the 45% rate of income tax after Chancellor Kwasi Kwarteng acknowledged that it was proving a "massive distraction".

Mr Kwarteng announced a series of tax cuts and changes in his mini-budget on September 23, before performing the U-turn. The government has not said how they will be paid for.

So how many people will benefit from them and how much will they cost?

Income tax 45% rate

The top rate of income tax for those earning more than £150,000 a year was reduced from 50% to 45% by then Chancellor George Osborne from April 2013.

A decade on, the rate was to have been abolished in England, Wales and Northern Ireland, leaving top earners paying the 40% rate instead. Mr Kwarteng has confirmed that this will not now go ahead.

The government said it would have meant a tax cut for 660,000 people next year.

The Treasury said the policy would cost around £2.2bn in 2025-26 and £2.1bn the following year. The costings in the first few years of the policy were uncertain because of wealthy taxpayers being expected to move their earnings between years to take advantage of the cut.

Scotland has a different system of income tax rates and bands, which is set by the Scottish Parliament. The current top rate for those earning over £150,000 is 46% and is not affected by Mr Kwarteng's announcements.

Income tax basic rate cut

The rate of income tax payable on incomes between £12,571 and £50,270 a year - known as the basic rate - will be cut from 20% to 19% from April 2023.

That should benefit 31 million income taxpayers in England, Wales and Northern Ireland.

Again, the changes to the basic rate do not affect taxpayers in Scotland, where there are currently five income tax bands, including a 19% starter rate.

The UK government expects the cut to cost just over £5bn in the first year. It's important to remember that this costing - and the others - haven't been checked by the Office for Budget Responsibility (OBR), as they would usually be for a budget.

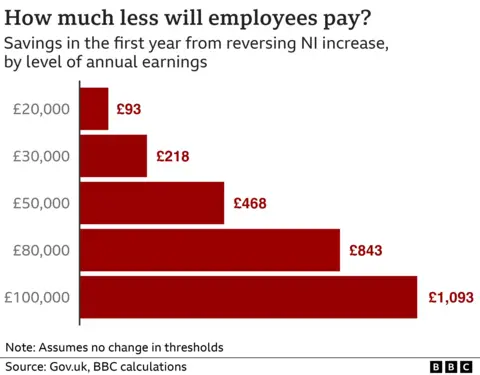

National Insurance reversal

A 1.25p in the pound increase in National Insurance was introduced in April 2022. It is now being reversed from 6 November.

It will apply throughout the UK, to about 28 million people.

It also applies to employers, the government says it will affect about 920,000 businesses.

The cut will cost the government about £17bn a year according to its estimates, although it expects to get about £3bn of that back if employers use their cut to raise wages or profits.

Stamp duty cut

The price at which Stamp Duty Land Tax starts to be payable on property purchases in England and Northern Ireland has doubled, from £125,000 to £250,000.

There is also a special rate for first-time buyers. The price at which they start paying stamp duty has gone up from £300,000 to £425,000.

There were about 1.1 million residential property transactions on which stamp duty was paid in the last year.

The changes will cost the government about £1.5bn a year in lost tax revenue.

Scotland and Wales have separate systems of taxation for property transactions so the proposed stamp duty changes will not affect purchases there.

Cancelling corporation tax rises

Corporation tax is paid by companies on their profits.

The then Chancellor Rishi Sunak announced in March 2021 that the rate of corporation tax would be increasing from 19% to 25%, from April 2023.

But businesses with profits below £50,000 would have stayed at the 19% rate, with the rate then increasing gradually so that only businesses with profits over £250,000 were meant to pay the full 25% rate.

Mr Sunak estimated that would mean 70% of companies - about 1.4 million of them - would be unaffected and 10% - about 200,000 - would pay the full 25% rate.

The Treasury says cancelling the planned rise will cost it £12bn next year and £17bn the year after.

The government hopes the decision will encourage businesses to invest and increase growth in the economy.

Changes to IR35

From April 2023, the government has decided to repeal the changes to the rules on off-payroll working, known as IR35, which were introduced in 2017 and 2021.

The point of the regulations was to make businesses responsible for making sure that contractors they were employing, via another company, were actually entitled to that status and should not be paid directly via payrolls.

The change to the rules will mean that across the UK it's up to the contractors themselves to make sure they have the right status and are paying the right amount of tax instead of putting the burden on employers.

The Treasury expects this change to cost it just over £1bn next year, rising to £2bn in 2026-27.

About 4.4 million workers in the UK are classified as self-employed, but it is not clear how many of them will be affected by the change.