Russia sanctions: What impact have they had on its oil and gas exports?

Getty Images

Getty ImagesSince Russia's invasion of Ukraine, many countries have pledged to end or restrict their oil and gas imports to curtail Moscow's revenues and hinder its war effort.

The Russian economy is highly dependent on its energy sector, and Europe is a major importer of Russian energy, making cutting back difficult.

What sanctions are in place?

EU nations have ended imports of Russian oil brought in by sea, and a ban on refined oil products will come in from 5 February.

The United States said last March it would stop importing Russian oil, and the UK said it was banning Russian crude oil and refined products with effect from 5 December.

Reuters

ReutersAn oil price cap approved by Western allies in December also aims to prevent Russia getting more than $60 (£48) for a barrel of crude oil.

Russia's gas sector has also been targeted. The EU said in March it would cut gas imports from Russia by two-thirds within a year. The UK, which only imported small quantities of Russian gas, it has now ended this altogether.

Have the sanctions been effective?

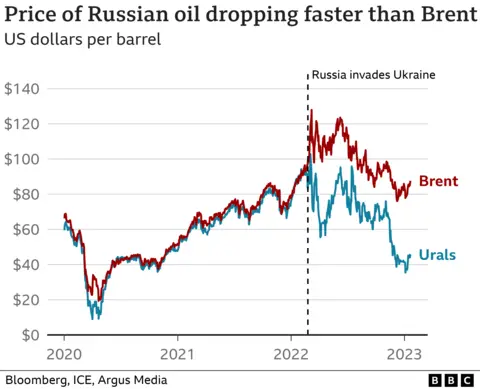

Urals oil is currently being exported from Russia's north western sea port of Primorsk for around $40 per barrel, from where it has largely gone to European destinations.

The value of Russian oil from other ports and pipelines varies, but the Urals price has fallen across the board since the EU banned imports of Russian oil by sea.

The price cap on Russian oil was agreed by the world's major economies at the same time. But energy analyst Ben McWilliams believes it is the EU oil embargo impacting the price, rather than the price cap.

"Russian oil is being traded at around $50 (£40) per barrel. That has been driven by the embargo because Russia now has to try to sell elsewhere."

Moscow is losing out on about $175m (£140m) a day from fossil fuel exports due to these measures, according to a study by the Centre for Research on Energy and Clean Air (CREA).

Getty Images

Getty ImagesMajor Russian banks have also been removed from the international financial messaging system Swift.

Countries continuing to trade with Russia have sought ways around this. Both China and India are increasingly making their oil and gas purchases in their local currencies.

Who is buying Russian oil?

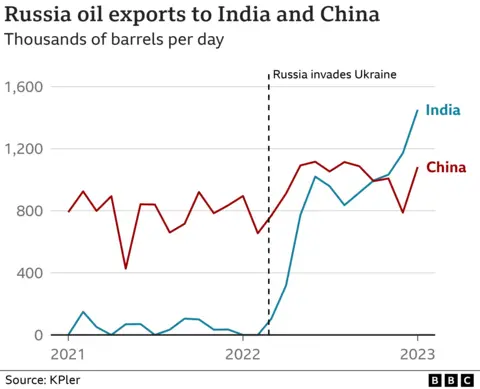

India, China and Turkey all ramped up their purchases of Russian oil last year - and together they now make up 70% of all Russian crude flows by sea.

And Russia was offering its oil at a significantly lower price than the global benchmark Brent crude.

At the start of 2022, Russia supplied less than 2% of India's oil imports, but it is now on course to become its largest single supplier.

China's imports of Russian oil have fluctuated, but have also risen over the past year.

In 2021, more than half of all Russia's crude oil exports went to countries in Europe. But in 2022, UK imports of oil from Russia fell sharply and other European countries have cut back too.

But some have remained heavily reliant, such as the Slovak Republic and Hungary.

European countries have been looking to see if they can source supplies elsewhere.

The International Energy Agency (IEA) club of oil importing countries agreed to release 120m barrels of crude from their stocks in 2022. The US also released some of its strategic reserves last year.

But calls for oil-rich nations such as Saudi Arabia, the United Arab Emirates (UAE) and Venezuela to increase production have not been successful.

Opec and other major oil producers cut production in late 2022 to sustain prices.

Europe still relies on Russian gas

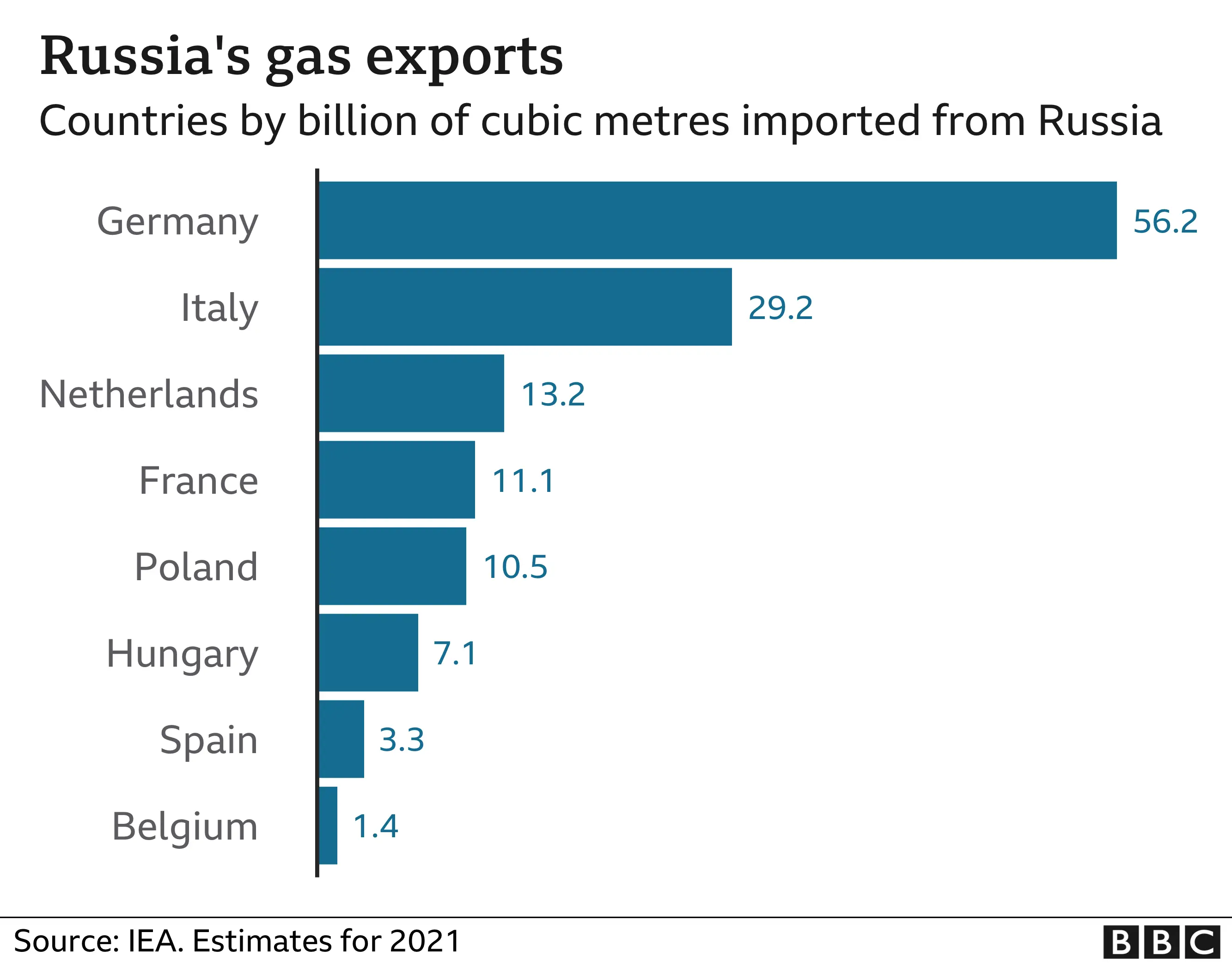

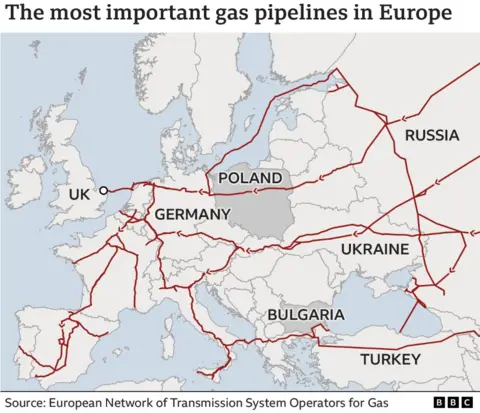

Reducing gas imports from Russia has been a major challenge for many European countries, as the continent has been getting most of its gas through pipelines linked to Russia.

In 2021, Russia was supplying EU countries with 40% of their natural gas, with Germany the largest importer, followed by Italy and the Netherlands. That had dropped to around 17% by August 2022, according to EU figures.

In 2021, the UK got just 4% of its gas supply from Russian. It now imports none.

EU states are increasingly looking to ship in liquefied natural gas (LNG) in tankers from producers such as the US and Qatar.

The shift towards LNG imports by European countries has been very significant, replacing supplies from Russia.

However, "there aren't enough LNG terminals in Europe", says energy advisor Kate Dourian. "This will be a problem for Germany, particularly."

There are several new LNG terminals planned and some already under construction across Europe as countries try to boost their capacity.

Clarification 21 October: A previous version of this story contained a graphic with the title: 'The UK has much less gas storage than some other European countries'. The aim was to show how much gas the UK had in storage at that time. It was not intended to show the UK's total capacity for gas storage.